DDM Identifies Nearly 1,000 Deals with a Total Volume of $17.5 Billion

According to Digital Development Management’s (DDM) 2024 report, the number of deals has increased, while the total transaction volume has decreased compared to the previous year. However, this decline is solely due to Microsoft’s nearly $69 billion acquisition of Activision, which drove 2023’s transaction volume to an unprecedented high.

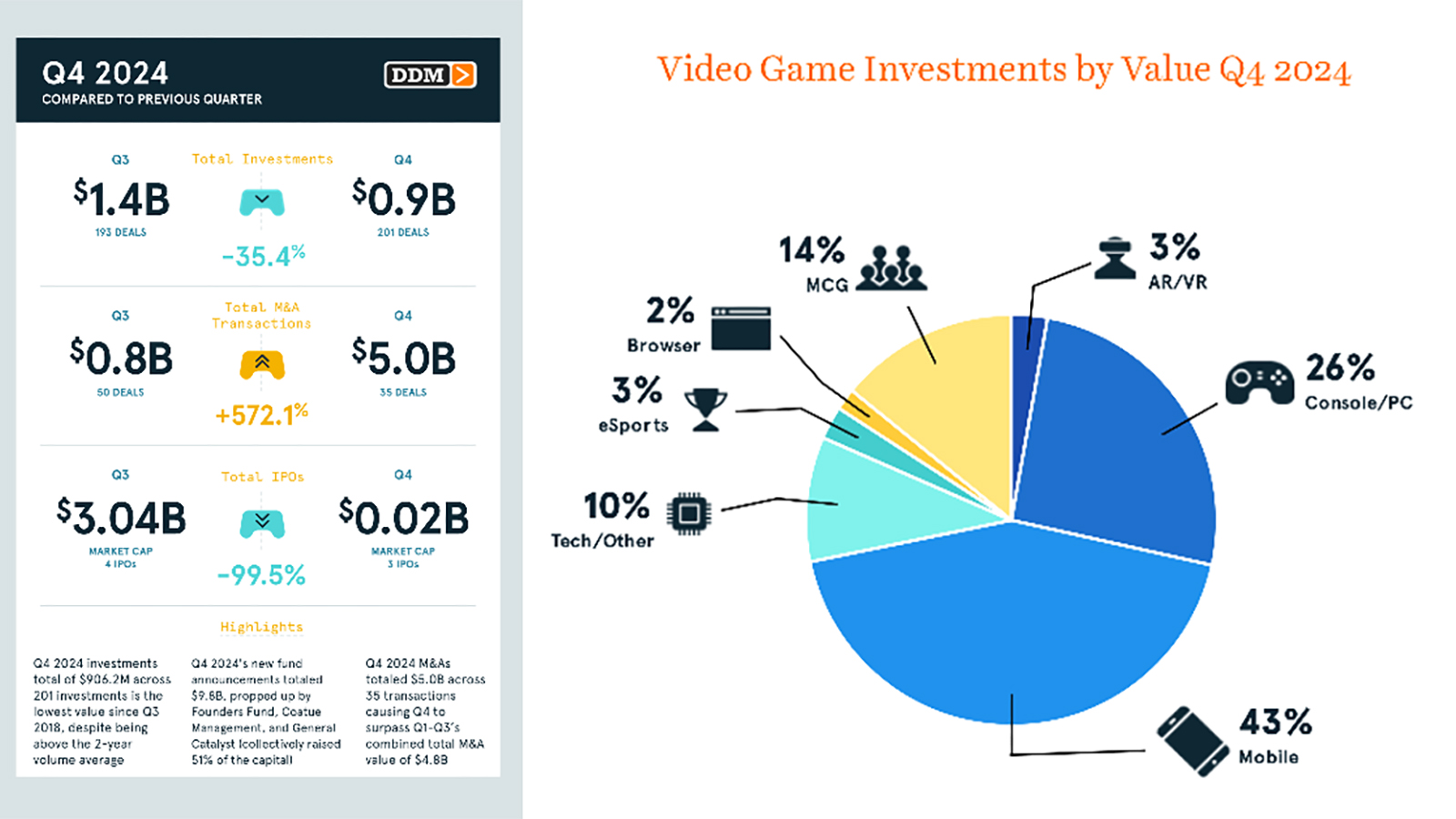

In total, DDM recorded approximately $17.5 billion in investments across 985 deals in 2024, including investment rounds, acquisitions, and IPOs within the gaming industry. The fourth quarter alone accounted for $6 billion in investments, making it the most successful quarter of the year, according to the report’s authors.

An analysis of individual segments highlights the volatility of the three main areas—investments, mergers & acquisitions (M&A), and IPOs—as even a few major deals can significantly impact overall figures. This is particularly evident in acquisitions: the total value of gaming-related M&A transactions plummeted from $76.8 billion in 2023 to $9.9 billion in 2024. However, the 2023 figure includes Microsoft’s $68.7 billion takeover of Activision Blizzard. Without this single acquisition, the total value of gaming company acquisitions recorded by DDM in 2023 stood at just $8.1 billion—significantly lower than in 2024.

Even excluding the Activision mega-deal, the investment and M&A market in gaming saw substantial growth in 2024.