Gaming Investments and M&As Decline in Q3

The global gaming sector has seen a robust 2024, with year-to-date investments and M&As reaching $10.38 billion across 726 transactions. This is according to the new Q3 DDM Games Investment Review.

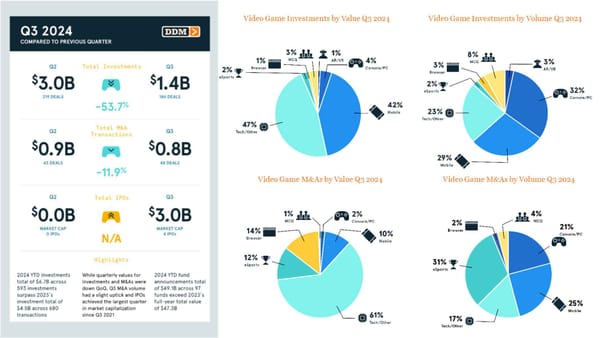

While Q3 recorded a sharp decline in value compared to Q2, the overall trajectory for 2024 surpasses last year’s performance, driven by strong year-to-date growth in investments and transaction volumes.

With $10.38 billion in investments and mergers and acquisitions (M&As) across 726 deals, 2024 year-to-date is slightly ahead of 2023, which recorded 10.36 billion Dollar and 632 deals during the same period. This marks a nearly 16 per cent rise in transaction volume despite a modest increase in value, highlighting the industry’s recovery from prior downturns.

Q3 2024 saw a pronounced dip, with investments and M&As totalling 2.2 billion Dollar across 234 deals, down 44 per cent in value and 11 per cent in volume from Q2’s 3.9 billion Dollar and 262 deals according to the numbers of Digital Development Management (DDM). M&As contributed 751 million Dollar across 48 transactions. Investments contributed 1.4 billion Dollar across 186 investments during Q3. The decline in M&A value reflects the absence of large-scale deals like Scopely’s 4.9 billion Dollar acquisition in 2023. While the numbers in investments is a substantial decline in value and volume, the investment value is still larger than any quarter from 2023 and the volume is still substantially above 2020’s average of 127 investments per quarter, DDM says.

2024 has also seen robust fundraising activity, with 49.1 billion Dollar raised across 97 new funds year-to-date. That is 70 per cent more in value and 2 per cent in volume over 2023. Q3 accounted for $12.5 billion across 27 funds.

Despite Q3’s setbacks, the gaming industry remains on track to surpass 2023 in total investments and M&A activity, driven by sustained volume growth and notable recovery trends in fundraising, DDM believes.