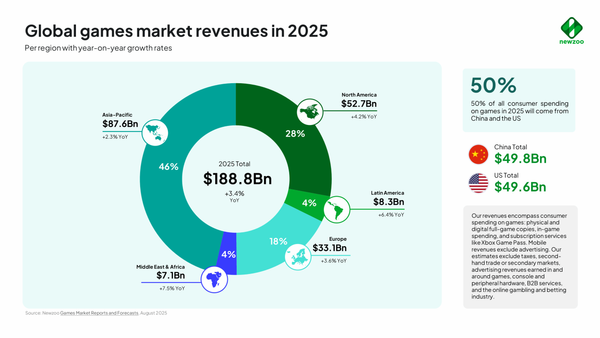

Global Gaming Revenue Is Expected to Reach $188.8 Billion in 2025, With Growth Set to Continue

In its Global Games Market Report, Newzoo predicts that total global revenue will reach $188.8 billion in 2025, representing a 3.4% year-on-year increase. It is expected that 50% of all consumer spending on games will come from China and the USA.

Newzoo has published this year's free edition of the Global Games Market Report. The market researchers expect a moderate increase in audience numbers by 2025. The global player base is expected to reach 3.6 billion (+4.4% year on year), but the proportion of the online population playing games is plateauing.

Of these 3.6 billion, 936 million will be PC players (+3.1% YoY), 645 million will be console players (+2.5% YoY), and 3 billion will be mobile players (+4.5% YoY). The growth of players on Steam exceeds the growth in the entire PC sector, with momentum in China and Japan being highlighted in particular. However, of the 3.6 billion players worldwide, only 44 per cent (1.6 billion) are classified as payers, i.e. individuals who have spent money on video games on PC, console, mobile, or cloud platforms in the past six months.

Newzoo: "The willingness to spend keeps growing among the global gamer population. With the 4.9% growth this year, it is outpacing the 4.4% total player growth. Total revenues are expected to grow 3.4% in 2025 to $188.8 billion, and the average spending per paying gamer will be $119.7."

Total global games revenue is expected to reach $188.8 billion (+3.4% YoY), with China ($49.8 billion) and the USA ($49.6 billion) accounting for 50% of all consumer spending on games. Europe is expected to generate $33.1 billion in gaming revenue, a 3.6% increase on the previous year and slightly ahead of the Asia-Pacific region. PC revenues are expected to reach $39.9 billion (+2.5% YoY), console revenues are forecast at $45.9 billion (+5.5% YoY), and mobile revenues are predicted to reach $103.0 billion (+2.9% YoY). The most profitable genres will be shooters on PC ($9 billion, down 5%), sports games on consoles ($10.6 billion, up 3.5%), and RPGs on mobile ($18.7 billion, down 14.7%).

In the PC sector, growth in China and Japan is once again leading the way, alongside strong releases this year and in 2024, "returning Activision Blizzard titles", and increased engagement with esports. Newzoo: "Long-standing live-service games (e.g. League of Legends, Rainbow Six: Siege and Apex Legends) declined, while growth for The Sims 4 and Counter-Strike 2 could not fully offset the downturn." In the console sector, the Nintendo Switch 2, higher software prices and major releases are driving growth. Development is most robust in areas where Switch has been popular, such as Eastern Asia and France.

In the mobile sector, stronger growth is seen in regions that are mobile-first, while growth in the Asia-Pacific region is declining. Direct-to-consumer models are continuing to be adopted in the Western market, while regulatory changes are impacting businesses worldwide. The top-grossing titles of 2024 are expected to perform well in 2025, although a slowdown is likely as the games age. Roblox is expected to continue its strong growth into 2025 and match-and-merge games are set to remain successful. Discoverability remains a significant challenge, with content becoming more and more scattered across different platforms.

The global games market is expected to reach $206.5 billion by 2028, reflecting a Compound Annual Growth Rate (CAGR) of 3.0%. The number of players is expected to reach nearly four billion worldwide. The console market is set to experience significant growth (+4.7% CAGR from 2025 to 2028), driven by the release of Grand Theft Auto VI in 2026 and the prognosted arrival of Gen-10 consoles in 2027. The PC market will grow steadily (3.3% CAGR 2025–2028), buoyed by adoption in the Asia-Pacific region and premium releases. The mobile market will continue to grow (+2.2% CAGR 2025 to 2028), albeit less explosively than before, in line with general economic growth and increased spending outside Apple's and Google's stores.

Michiel Buijsman, Principal Market Analyst (Newzoo): "The strongest momentum through 2028 will come from console and PC, narrowing the gap with mobile. The next few years will be defined less by market size and more by how publishers capture lifetime value. Early Access timing, post-launch support, and the rise of UGC ecosystems like Roblox are no longer tactical choices - they're core strategies."

Never miss anything from the German, Swiss and Austrian games industry again: subscribe for free to our Daily newsletter and get all news straight to your inbox.