game Unveils Plan for Competitive Games Funding at International Level

While the next government in Berlin is negotiating its coalition agreement, game presented a specific proposal for the introduction of a tax-based games funding programme. The fund model should be retained and adapted. According to Goldmedia, lucrative multiplier effects could be expected.

The mention of a tax-based model for games funding in the first draft of the coalition agreement has raised hopes that the incoming government will implement it. At a press conference, the game association presented what such a model could look like.

Specifically, the association’s proposal comprises seven points for a tax-based funding model. In addition, there are four points aimed at adapting the existing fund model, which the association believes should continue so that competitive games funding aligned with international standards can be established in Germany.

In developing the concept paper, the association drew inspiration from countries such as France. The views and experiences of the more than 500 member companies were also incorporated into the paper.

The seven points for the tax-based funding programme are:

1. Funding Rate: A reliable, uncapped tax incentive is proposed, offering a 30% funding rate or 35% for SMEs.

2. Tax Type and Liability: The incentive would be linked to corporate income tax. If the tax liability is negative, the funding is paid out, similar to Germany’s R&D tax credit system.

3. Eligibility: Eligible applicants are non-exempt corporate taxpayers conducting qualifying games projects. SMEs can choose between the tax model or the existing fund but not both for the same project.

4. Assessment Basis: Eligible costs include personnel and production (e.g. servers), plus depreciation, external services, licensing, software, marketing, and overheads—up to 100% of project costs.

5. Minimum Size: Projects must have a minimum budget of €300,000. No maximum limit applies.

6. Funding Scope: Support covers prototypes, full productions, co-developments, DLCs, ports, and for the first time live-service games, aligning with current industry trends.

7. Application Process: A two-step process: First, a project sponsor certifies eligibility (renewed annually for live-service games); second, the tax office processes the application—potentially through centralised offices.

In addition to these seven points, game also presented four points on how the current fund-based subsidy model should be adapted once there is a tax-based model. Internationally competitive framework conditions for game production will only emerge through the combination of a fund-based model for young companies, which are often unable to finance projects until they file a tax return, and the new tax-based model, which also enables established companies to make larger investments.

The four points for adjusting the previous model are:

1. lowering the minimum project size to €100,000 per project,

2. a maximum funding amount of €2 million per project and per year, to distinguish it from tax incentives,

3. the option of combining funding with state funds,

4. (Practicable) possibility of an early start to measures in order to exclude waiting times in the application process at one's own entrepreneurial risk and to be able to start projects earlier.

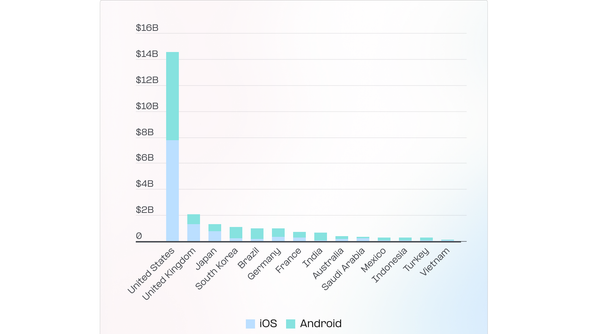

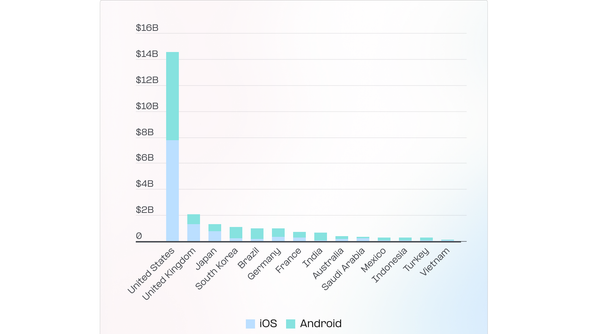

The game proposal is supported by data from Goldmedia, which has examined the leverage effects of tax-based funding for games in Germany. The basis for this was data from 2023. According to this, for every 1 euro of funding, 4.80 euros of additional investment is generated in funded games projects. Goldmedia puts the additional gross value added at 8.70 euros for every euro of funding. And, according to Goldmedia, every euro of funding would ultimately generate 3.40 euros more in tax revenue and social security contributions.

"The games industry can and will become a strong driver of innovation and growth in Germany as well. With tax incentives for games, we can become competitive as a games location and finally realise the great potential in the long term. The strong leverage effects for additional investments and tax revenues, which have been calculated for the first time, impressively show what is possible. Now it is up to the federal and state governments to move quickly to implement them. To this end, we as the games industry are presenting our specific funding concept today. This will finally make us internationally comparable and reliable in Germany as well, and put an end to the back and forth of recent years. Then we can also catch up with the top game production locations worldwide," says Felix Falk, managing director of game – the German Games Industry Association.

Never miss anything from the German, Swiss and Austrian games industry again: subscribe for free to our Daily newsletter and get all news straight to your inbox.