Latest Trends and Insights From the GDC 2025 State of the Game Industry Report

The 13th GDC 2025 State of the Game Industry Report includes the following findings: 11% of respondents were laid off in the past year, half of all developers are self-funding their games, and 80% of developers are focused on creating games for the PC market.

The GDC 2025 State of the Game Industry report has been released. Over 3,000 developers (25% female, 66% male, 6% non-binary) from 86 countries were surveyed on a range of topics. For this report, GDC, aka Informa Connect, worked with research partners Omdia to analyse the survey data and with the team at Game Developer. However, almost two-thirds of respondents were from North America, so the perspective may be skewed; 58% from the US, 7% from the UK, 6% from Canada, 3% from Australia, 1.6% from Poland & Brazil and 1.3% from Germany. The free report can be found here.

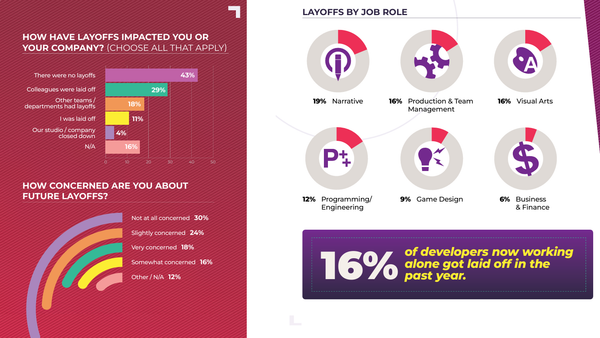

About 11% of respondents said they had been laid off in the last 12 months. 29% said that colleagues had been made redundant and 18% said that other teams / departments had been made redundant. 4% said the studio/company had closed down .43% of respondents said there had been no layoffs. Nevertheless, the authors write regarding the 16% who answered "N/A": "That number may actually be higher, as many of our “N/A” write-in responses were from students and graduates who are having trouble finding jobs in the current market." According to the survey, the most common reason given by companies for layoffs was restructuring, followed by falling revenues and market changes. 19% of developers said that 'no reason' was given for any redundancies.

"We asked developers to share how many hours they work per week on average. While the majority of developers continue to work 40 hours or less per week, that percentage has decreased from 64% last year to 57% today. It’s the first time the number has gone down since we started asking this question in 2019. Longer workweeks are seeing an uptick: 13% of developers say they’re working 51+ hours per week on average, compared to 8% last year." - GDC 2025 State of the Game Industry Report, p. 36

The majority (52%) of developers surveyed work in organisations that use Generative AI tools. A third (36%) of developers say they use them personally, up from 31% last year. "But it appears that as usage has gone up, curiosity has gone down. Less than one-tenth (9%) of developers say their companies are interested in Generative AI tools, down from 15% last year. In comparison, 27% say their companies have no interest in using them, a 9-point increase from 2024," the report said.

80% of developers say they're currently making games for PC (up from 66% last year), and three quarters (74%) say they're interested in the platform (up from 62%). The Steam Deck was also mentioned surprisingly often as an interesting 'other platform'. Sony leads the way in the console sector. About 38% of developers are currently making games for PlayStation 5, compared to 34% for Xbox Series X|S and 20% for Switch, while 8% of developers surveyed are working on the recently unveiled Nintendo Switch 2. Android is one percentage point ahead of iOS at 29%.

"Mobile game development has increased for the first time since 2020, with 29% of developers currently making games for Android and 28% for iOS (up from 24% and 23% respectively). Much of that is in Brazil and the East and South / Central / West Asia regions, where over half of developers say they work on mobile games." - GDC 2025 State of the Game Industry Report, p. 20

Mac is at 23%, VR/AR at 14%. In the XR space, Meta Quest (63%), Steam VR (45%), Apple visionOS (26%) and PlayStation VR/VR2 are the most interesting platforms. Media platforms (Netflix, TikTok) and UGC platforms (Roblox, Minecraft) are at three percent each. Around 13% of developers are currently making games for Xbox Game Pass, compared to 9% for PlayStation Plus (Extra or Premium).The "biggest surprise", according to the authors, are browser games. 16% of developers are working on releases for web browsers (+9%). It's the highest percentage of developers working on web browser games in a decade.

Unity and Unreal Engine remain the most widely used game engines for developers, tied at 32% each; 13% use proprietary or in-house engines, 4% use Godot.

When asked "Would You Want to Make a Live-Service Game As Your Next Title" (p. 25), 42% of developers said no, 13% said yes and 16% were already working on it. 29% did not answer. In total, 33% of AAA game developers surveyed are working on live service games.

The Top 5 Business Models are: 1. 57% Premium game (digital or physical) 2. 32% Free to download 3. 24% DLC/updates 4. 22% Paid in-game items 5. 18% Paid in-game currency

"The most-used method, by far, is self-funding. Over half (56%) of developers said they've invested money into their own games. This was followed by publishing deals and project-based funding (28%), along with government funds or grants, venture capital, and co-development contracts (at 15% each). Indie developers were the most likely to turn to self-funding, with 82% saying they've put their own money into their games. About 40% of AA developers and 29% of AAA developers have self-funded their games as well. However, co-development contracts have the highest satisfaction, with one-third (37%) calling the method 'very successful.' Accelerators saw the least success, with 43% of developers saying they were 'not at all successful.' This was followed by venture capital (32%) and crowdfunding (31%)." - GDC 2025 State of the Game Industry Report, p. 31

Never miss anything from the German, Swiss and Austrian games industry again: subscribe for free to our Daily newsletter and get all news straight to your inbox.