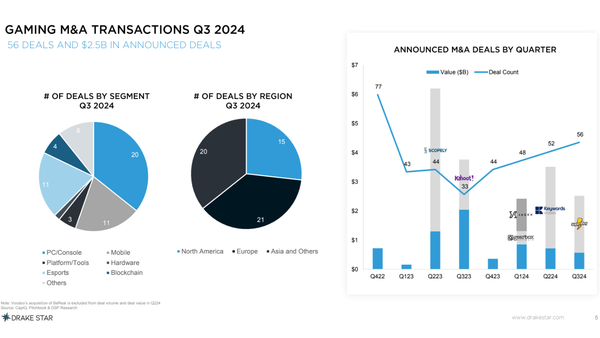

Drake Star Sees Gaming M&A Activity Increase for Fourth Quarter in a Row and More Insights

M&A activity in the gaming sector has increased for the fourth consecutive quarter, with the two largest deals of the year being acquisitions by private equity firms, according to investment bank Drake Star in its Global Gaming Report Q3 2024. Activity is expected to continue to increase. Michael Metzger, Managing Partner, provides further insight.

Global technology investment bank Drake Star has released the Global Gaming Report Q3 2024, which analyses the quarter of 2024 for gaming and esports and outlines what to expect for the rest of the year and into 2025. For example, gaming M&A deal activity continued to rise for the fourth consecutive quarter, with $2.5 billion in disclosed deal value and a 70 per cent increase in the number of deals compared to Q3 last year.

The biggest deal was Playtika's acquisition of mobile games developer SuperPlay for $700 million at closing and up to $1.95 billion including earn-out. Both companies are based in Israel. Infinite Reality (US) acquired tools and services provider Landvault (UK) for $450 million and Nazara from India acquired UK mobile games developer Fusebox for $27.2 million. Daybreak Games (US), a subsidiary of Swedish games company EG7, acquired Singularity Six (Palia) and Warner Bros. Games acquired Player First Games (MultiVersus). Other notable acquisitions included Tencent (Aojue Digital), Krafton (Tango Gameworks), Capcom (Minimum Studios) and Keywords (Wushu Studios).

Drake Star: "$1.1B was raised in private financing through 181 deals, a notable growth in deal value, but the number of deals was similar relative to Q2. Large financings included Infinite Reality ($350M), Hybe IM ($80M), Gcore ($60M), Volley ($55M) and Saber Interactive. Investors continue to invest primarily in seed / early-stage companies (over 90%). Blockchain gaming attracted ~32% of all investments and platform / tools ~23%. Funding for growth stage gaming studios continued to be challenging. Andreessen Horowitz and Bitkraft were the most active large gaming VC over the last 12 months followed by Play Ventures. Early-stage gaming and consumer investor Patron has raised $100 million for its second fund."

Tencent backed Shift Up, known for Stellar Blade with publisher Sony Interactive Entertainment SIE and Goddess of Victory: Nikke with publisher Level Infinite, had a good IPO, with shares rising around 50 per cent on debut (raising $320 million), while Nazara raised over $100 million in equity. "With a gradual recovery in public markets, Drake Star Gaming Index grew 10.2% for the first 9 months of this year. Top performers were SEA, Konami and Krafton and laggers were Ubisoft, Corsair and Unity."

Drake Star: "PE firms have been a major consolidator this year (CVC /Jagex, EQT/ Keywords), and we anticipate more acquisitions / take-private deals led by financial sponsors. We also expect more divestitures of large gaming divisions. For private financings, AI, mixed reality, platform and tools continue to be hot segments. As broader gaming markets continue to recover, we anticipate IPO ready gaming companies to start exploring their listing ambitions in 2025."

M&A activity is expected to continue to increase for the remainder of this year and next, continuing the strong growth seen last year, driven by falling interest rates and a gradual, broader recovery in the public gaming market, Drake Star believes. "While we expect some large transformative deals from industry leaders such as Tencent, Take-Two, Savvy/Scopely and Playtika, the trend of strong growth in mid to small sized deal count will likely continue. With limited mid / late funding available, some gaming studios will choose an earlier exit and join a larger company."

When asked about this development in M&A activity for the fourth consecutive quarter, Michael Metzger, Managing Partner, Los Angeles, told GamesMarkt: "The rise in M&A activity indicates growing confidence among acquirers. During tough times, large public companies tend to focus inward and pay less attention to inorganic growth. This year, the two largest deals involved acquisitions by private equity firms at attractive valuations, showcasing their confidence and positive outlook for the gaming sector in the medium term. Meanwhile, there has been a scarcity of growth rounds for gaming studios - whether mobile, PC, or console. As a result, some smaller gaming studios with limited runway have opted to be acquired by larger gaming companies, often at valuations lower than their last funding round."

GamesMarkt: Would you agree with the statement that it is currently difficult for game companies to get funding?

Michael Metzger: There remains a robust number of pre-seed and seed financing rounds, but challenges persist for Series A and later-stage funding. We anticipate that capital for these later rounds will gradually increase over the next couple of years. Many larger VC funds are currently raising capital for their follow-on funds, although limited partners have been quite cautious. Strong exits and corresponding great fund returns will help drive new capital into these funds. For instance, Vgames’s portfolio company Superplay recently achieved an amazing exit to Playtika ($700M at close and almost $2B including earn-out). We need more successes like this to boost investor confidence.

GamesMarkt: Regarding the outlook: "We also expect more divestitures of large gaming divisions." Do you have any candidates in mind who might be affected?

Michael Metzger: We anticipate that several major gaming studios may be divested in the upcoming quarters. A potential example is Aristocrat's possible sale of Plarium and Big Fish Games. Aristocrat has publicly confirmed a strategic review of these studios, with CEO Trevor Croker discussing the possibility of divestiture or sale in a Wall Street Journal interview a few months ago (Aristocrat Will Consider Sale, Spinoff of Game Developers in Strategic Review - WSJ).

GamesMarkt: Do you think Unity is back on track? Under new CEO Matthew Bromberg, the engine maker has already taken some clear steps to regain the trust of developers.

Michael Metzger: I believe Matthew Bromberg has done a very good job in restoring trust with developers and the investor community. Unity continues to hold an unmatched market share in mobile games and apps, and I’m confident that under his leadership, he’ll find more effective ways to boost Unity’s revenue growth.

GamesMarkt: Ubisoft's share has suffered a lot in the last few months. After the release of Star Wars Outlaws, which fell short of expectations, the company announced a change in release strategy for its biggest release in the near future. What do you think of it?

Michael Metzger: Ubisoft has a strong portfolio of original IP games, and it's likely that over time, the company will find more effective ways to monetize its assets. With franchises like Assassin's Creed, Far Cry, and Tom Clancy's series, Ubisoft has a rich foundation to build upon as it continues to explore new strategies for maximizing the value of its games.

Never miss anything from the German, Swiss and Austrian games industry again: subscribe for free to our Daily newsletter and get all news straight to your inbox.