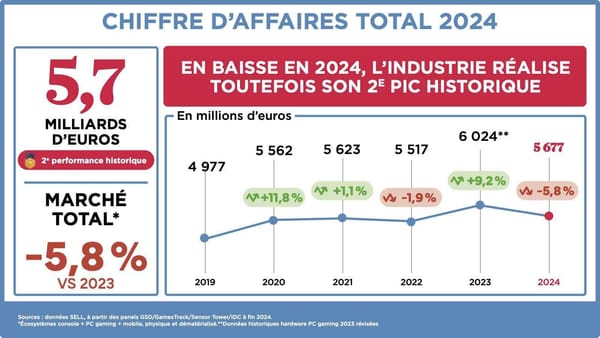

France's Games Market Shrinks by 5.8% to €5.68 Billion

In France, the third most important market in Europe, a decline in sales was also reported for 2024. As in Germany, the drop appears to be a correction following the disproportionate growth of previous years.

The market data was published by the French video game association Syndicat des Éditeurs de Logiciels de Loisirs (SELL) and is based on figures from GSD, GameTrack, SensorTower and IDC. According to the report, games, gaming hardware and accessories generated a total of 5.68 billion euros in France last year. This represents a decrease of 5.8 per cent compared to the previous year.

The development is similar to that seen in the UK and Germany, where market volumes fell by around 4 per cent and 6 per cent respectively. However, all three markets had recorded exceptionally strong growth in the years leading up to this.

Looking at the long-term trend, France continues to show steady growth. Between 2019 and 2024, the market volume increased by approximately 700 million euros, marking a double-digit percentage rise. In his statement, SELL President James Rebours refers to 2024 as a "transitional year". A closer look at the individual segments shows that the figures from France closely mirror those from Germany.

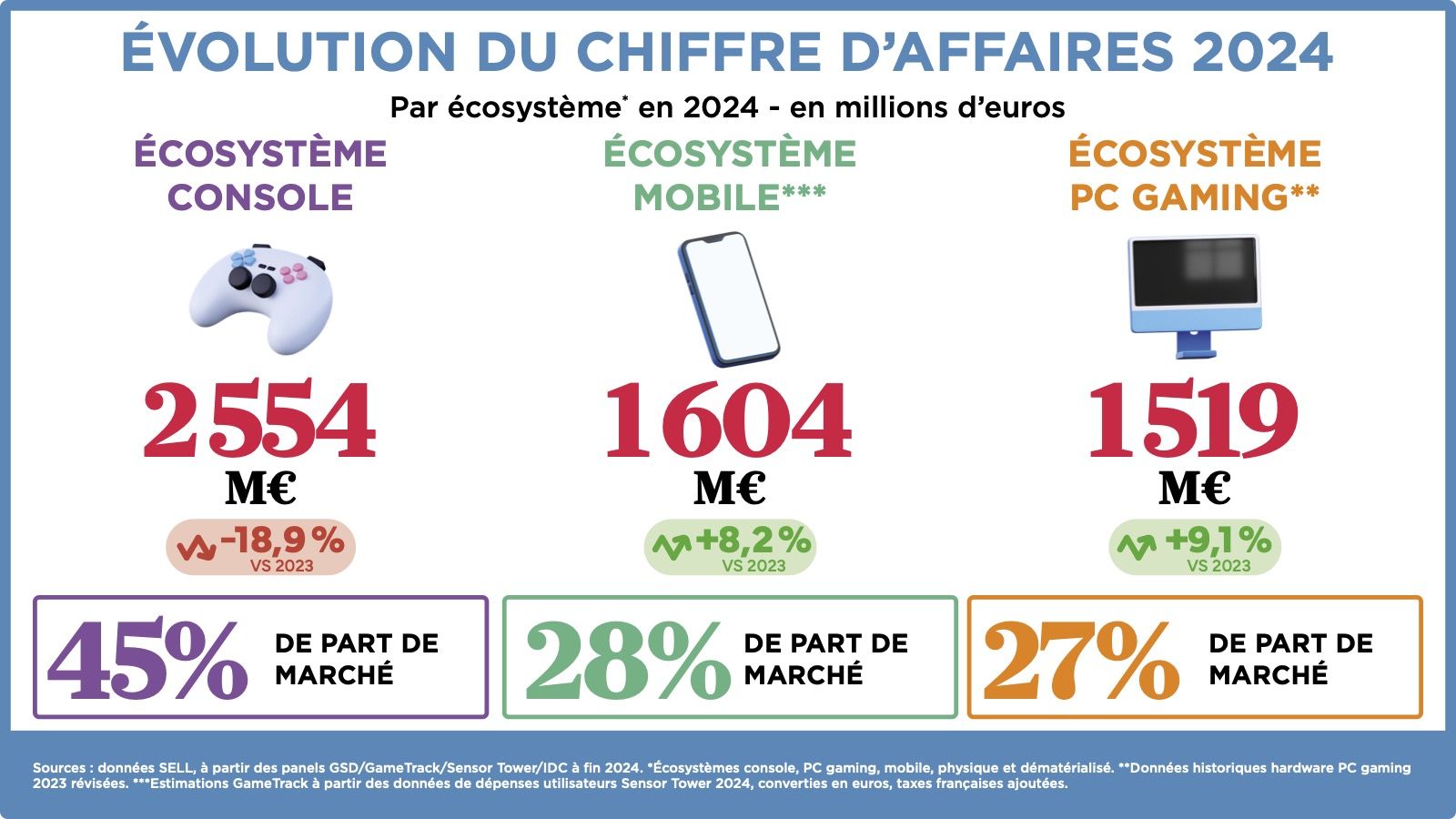

The decline is primarily driven by the console segment, which contributed 2.55 billion euros to the total market in 2024, representing a drop of 18.9 per cent. Sales declined across all three segments of the console market – software, hardware and accessories – with hardware seeing the sharpest decline at 35 per cent. As in Germany, console sales had surged in 2023 after years of supply issues were resolved. It was widely expected that this pent-up demand would eventually taper off.

The French data also highlights the ongoing shift from physical to digital distribution in the console segment. Revenue is now split 60 per cent digital to 40 per cent physical. Since SELL, unlike game, does not report online subscription services separately, it is likely that these revenues, which are growing in Germany, are included in the digital share as well.

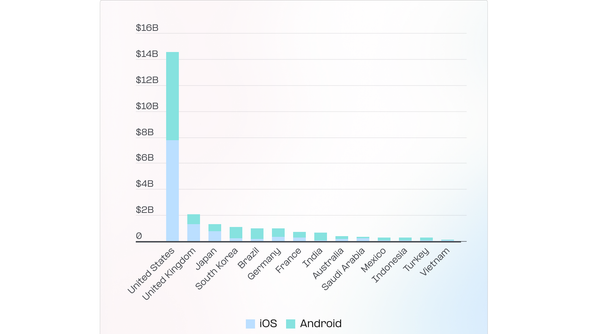

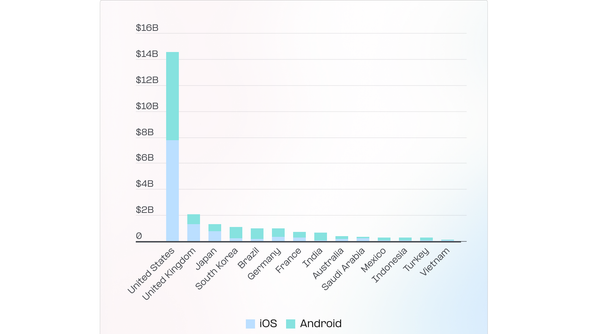

In the PC and mobile submarkets in France, there were no unexpected developments in 2024. PC game sales declined slightly by 3 per cent, while PC gaming hardware and accessories continued to post double-digit growth rates. As expected, mobile gaming remains dominated by free-to-play titles. Paid mobile games generated only 11 million euros in revenue in France in 2024.

Never miss anything from the German, Swiss and Austrian games industry again: subscribe for free to our Daily newsletter and get all news straight to your inbox.