Drake Star Sees Gaming M&A Activity Increase for Third Consecutive Quarter

M&A activity in the gaming sector has continued to increase for the third quarter in a row, with the two largest deals of the year being acquisitions by private equity firms, according to investment bank Drake Star. Activity is expected to continue to increase, with a broader recovery of the public gaming company market expected in 2025.

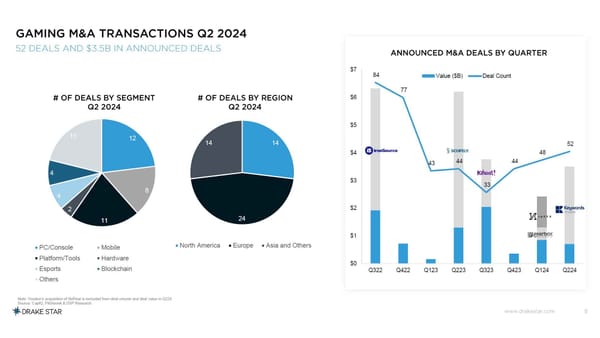

Global technology investment bank Drake Star has released the Global Gaming Report Q2 2024, which analyses the quarter of 2024 for gaming and esports, and outlines what to expect for the rest of the year and into 2025. "With 52 announced M&A deals and $3.5B in disclosed deal value, Q2 is the 3rd straight quarter of continued increase in deal activity that bottomed out in Q3'23 (33 deals)," the company wrotes. The largest gaming deal of the year to date was private equity firm EQT's acquisition of service provider Keywords for $2.8 billion. French mobile games developer Voodoo continued its diversification into consumer applications by acquiring social media app BeReal for $542 million; Infinite Reality acquired Drone Racing League and Action Face for $250 million; Nintendo acquired Shiver Entertainment from Embracer, the studio responsible for the Switch ports of Hogwarts Legacy and Mortal Kombat 1; and Miniclip, a subsidiary of Tencent, acquired game developer Futurlab, known for PowerWash Simulator.

On fundraising and public markets, the report continues: "Private financings seem to be stabilizing with 180 deals in Q2'24, staying flat compared to Q1 (191 deals). Most capital went into blockchain gaming, accounting for 40% of total deals and 44% of disclosed deal value. Zentry raised the largest round ($140M) in the quarter, followed by Spyke ($50M) and k-ID ($50M). Investment dollars continue to be mostly focused on early-stage companies (93% of total deals). Asia led with five of the largest financings, followed by three in Europe/UK, and one each in Turkey and the U.S. Very little VC money went to gaming studios. Bitkraft was the most active VC, followed by A16Z, Play Ventures and vgames."

The forecast is also more positive. "We anticipate that M&A activity will continue to strengthen throughout the remainder of this year and into 2025, buoyed by the broader recovery of the public gaming company market." Commenting on the outlook for GamesMarkt, Michael Metzger, Managing Partner of Drake Star Los Angeles, said: "We're excited to announce a rise in gaming M&A activity for the third quarter in a row as well as two major deals led by private equity funds (CVC & EQT) in 2024. We anticipate this trend of increasing deals to continue in the upcoming quarters. Once the Jagex/CVC and Keyworks/EQT transactions are completed, both companies are expected to be active buyers. We also foresee a further increase in overall gaming deal activity as the public market for gaming stocks recovers. Although some gaming stocks have outperformed the S&P 500, many have lagged behind, as reflected in the Drake Star Gaming Index. A rebound in the leading listed indie/AA companies this year could signal more deals within that segment."

Drake Star expects Tencent, Take-Two Interactive and Playtika to be active buyers. The volume of mid- to small-cap deals is likely to continue to increase. "As predicted, PE firms have been the top buyers so far in 2024 (CVC /Jagex, EQT/ Keywords), and we will likely see more acquisitions / take-private deals by PE firms. With limited mid / later stage financings available, we expect some gaming companies to opt for earlier exits. Following the Voodoo/BeReal deal, other gaming companies are likely to diversify in adjacent segments by acquiring mobile app companies."

In terms of funding, AI, Mixed Reality, Platform and Tools remain the hottest areas. They expect several IPO-ready companies such as Appsflyer, Discord and Epic to start planning for an IPO in the coming quarter. Sea, Konami, Logitech, CD Projekt, Capcom, Tencent and Krafton have been the top performers in the Drake Star Gaming Index over the past months, outperforming the S&P500 benchmark index. However, the broader gaming stock market has yet to recover. Some listed indie/AA games companies have seen a significant rebound this year, including Devolver Digital, Team17 and tinyBuild. Drake: "Gamestop raised $3.1 billion in equity and Embracer, Take Two and MTG raised ~$1.7 billion in debt."

When asked how Drake Star is looking at the blockchain/crypto gaming space, Metzger said: "In Q2 2024, a large number of investment rounds occurred in crypto gaming companies based in Asia and the U.S., including a notable $140 million round for Zentry. The resurgence in the valuation of leading cryptocurrencies and issued tokens may have bolstered confidence in the sector. We look forward to seeing a rise in engaging crypto games with substantial player bases in the upcoming quarters."

Never miss anything from the German, Swiss and Austrian games industry again: subscribe for free to our Daily newsletter and get all news straight to your inbox.