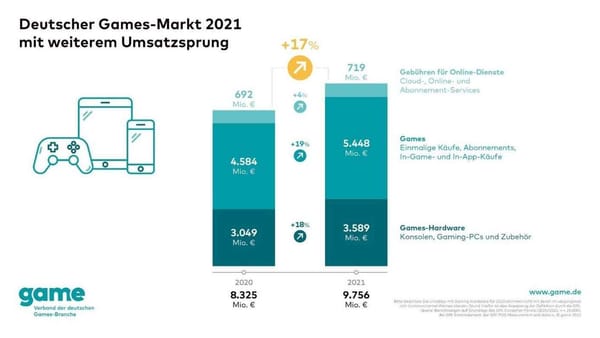

Sales in the German games market increased by more than 17 percent in 2021

German gamers spent almost 9.8 billion euros on games, services and hardware in 2021, 17 percent more than in the previous year. This was announced by the game industry association based on data from GfK and data.ai. In-game and in-app purchases as well as gaming hardware have been particularly driving the market growth.

The German games market also grew significantly in 2021. With games on all platforms, hardware for gaming use and fees for online services, around 9.756 billion euros were turned over - an increase of 17 percent compared to the previous year. However, the strong growth rate will lag behind 2020, after all the German games market grew by 32 percent in the first year of the Covid 19 pandemic. The biggest growth drivers were in-game and in-app purchases (+30 percent), consoles (+23 percent), and gaming PC accessories (+22 percent). All in all, the three market segments of games, gaming hardware and fees for online services increased compared to 2020.

Revenues from computer and video games increased by 19 percent year-on-year to around EUR 5.448 billion in 2021, with in-game and in-app purchases accounting for EUR 4.239 billion. The increase is attributed to the free-to-play trend and longer support for individual games with free and paid content. Revenues from one-time game purchases and subscription fees for games are declining. Sales of the one-off purchase fell by 9 percent to around EUR 1.064 billion (previous year: EUR 1.169 billion). Sales of monthly subscription fees for individual games, mostly online role-playing games, fell by 11 percent to 145 million euros. Specific information on the market share of games from Germany was not given. In 2020, the proportion was less than five percent. The vast majority of titles also came from abroad in 2021.

In the area of gaming hardware, sales increased by 18 percent to 3.589 billion euros. Although there were delivery problems with many consoles, sales of PlayStation, Switch and Xbox rose by 23 percent to 808 million euros. With accessories for game consoles, 306 million euros were turned over (+11 percent). Gamepads, steering wheels, and VR headsets specifically for consoles fall into this category. Gaming PCs (desktops and laptops) are responsible for sales of 970 million euros, which corresponds to an increase of 10 percent. The lion's share of gaming hardware sales comes from "accessories for gaming PCs", namely 1.506 billion euros (+22 percent). Input devices, monitors, graphics cards and VR headsets for gaming use belong to this category. In this category, too, the increased prices are likely to have favored sales growth, despite delivery problems, especially with graphics cards.

Gaming online services saw slight growth of 4 percent to EUR 720 million in 2021. In the previous year, the plus was much more generous at 50 percent, again an effect of the pandemic. Gaming subscription services such as Xbox Game Pass, EA Play, Apple Arcade, Google Play Pass and Ubisoft+ have been key contributors to growth in 2021 as their revenue increased by 22 percent to €220 million. Sales of online gaming services such as PlayStation Plus, Xbox Live Gold and Nintendo Switch Online fell slightly, from 439 million euros to 437 million euros. A similar trend was seen in cloud gaming services. In this area around PlayStation Now, Stadia and GeForce Now, a decline of 13 percent to 63 million euros was recorded. According to the industry association, some cloud gaming functions were integrated with other services free of charge, which is why certain sales were missing compared to the previous year.

"Following the historic leap in growth in 2020, the German games market continued to grow strongly in 2021. This also shows that those who discovered games for the first time during the lockdown also enjoy them in the long term," says game Managing Director Felix Falk. "The strong growth in gaming hardware is particularly pleasing. Whether game consoles or gaming PCs: once again, gamers in Germany have invested heavily in their equipment so that they can continue to enjoy games in the best possible quality in the future Demand could not always be met, so an even greater increase in sales would have been possible."

With a view to 2022 and the effects of the Ukraine war, the economic consequences and inflation, Felix Falk said: "First of all, it was interesting to see that in 2021 the high number of players and, above all, the usage times fell again, but this did not lead to the Sales fell. This, together with other factors such as the high demand for consoles that cannot yet be met and which shows the potential that still exists in the market, gives me a good feeling for further development."

The game market data is based on surveys by the GfK Consumer Panel and data.ai. The industry association writes about the data: "This includes, among other things, an ongoing survey of 25,000 consumers, representative of the entire German population, about their shopping and usage habits for digital games, as well as a retail panel. (...) GfK has the definition of gaming PCs adjusted. For better data comparability, this new definition has also been applied to 2020 market data, resulting in lower gaming hardware values for 2020 than communicated a year ago."