The European Games Industry

In the last two weeks, GamesMarkt has published nine articles on the European games industry, covering the "Big Five" key markets and four regions with their respective characteristics. All insights and articles (GamesMarkt Plus) at a glance.

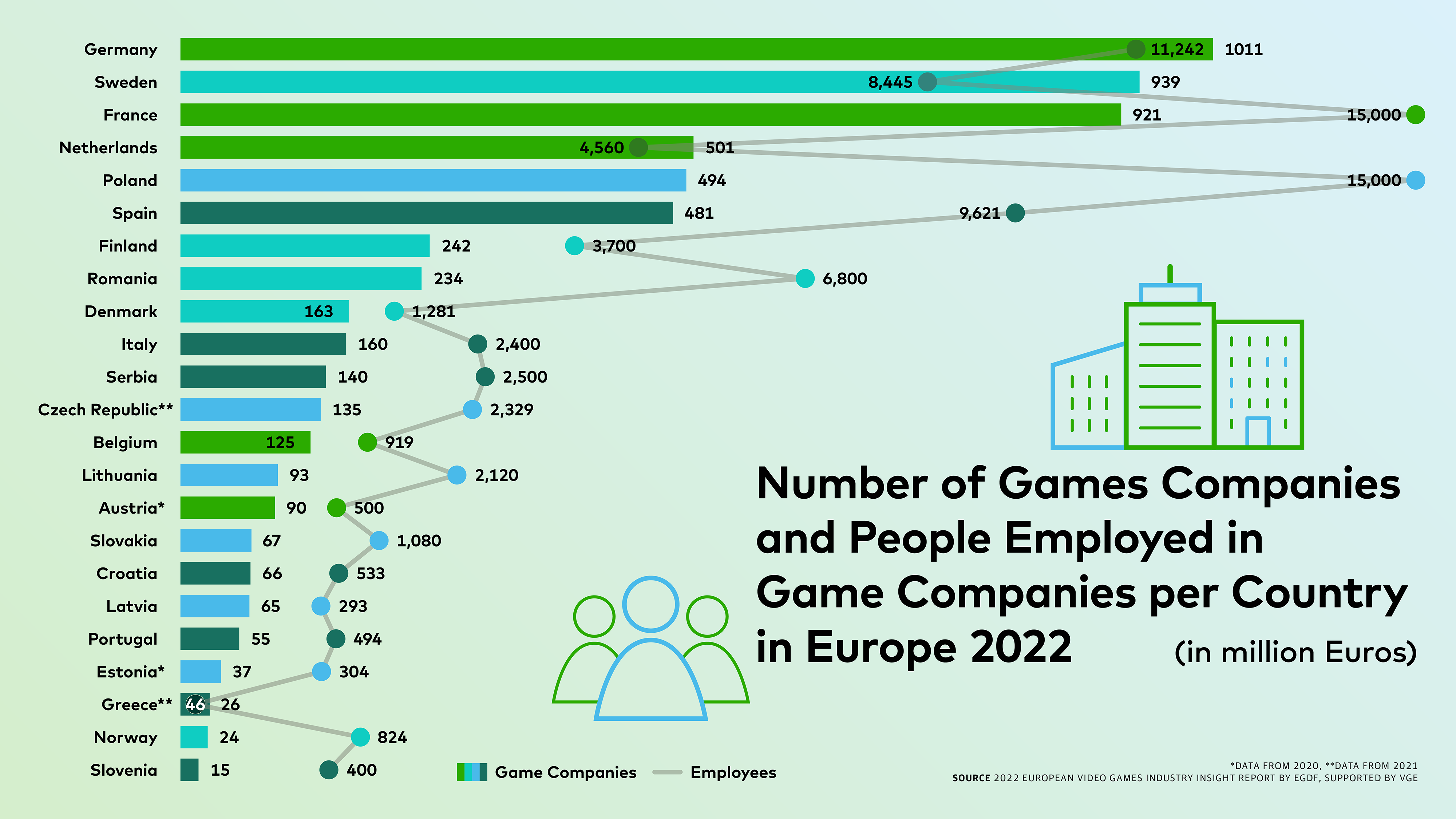

The games industry in Europe is very diverse, which is not surprising as each country has its own characteristics. In order to provide an overview of the European market, GamesMarkt has published several insight articles on the European key markets of France, Germany, Italy, Spain and the UK (based on reports from the local associations), as well as on specific regions: Nordics, Eastern Europe, Southern Europe and West and Central Europe. The latter is based on the 2022 European Video Games Industry Insight Report covering 20 European countries, published jointly by the European Game Developer Federation (EGDF) and Video Games Europe (VGE), and provided by their respective national associations.

A GamesMarkt Plus subscription is required for all articles.

Published at the end of June 2024, the European Video Games Industry Insight Report represents the most up-to-date aggregated data to date at the European level - and unlike the traditional total revenue of a market, it focuses on companies operating in that specific country. This industry turnover is the net revenue generated by all game development studios and publishers based in that country (local perspective), including subsidiaries of major global game industry conglomerates. Example: While the German market for computer games, hardware and related online services is worth 9.87 billion Euros in 2022, the annual local industry turnover for games made exclusively by studios and companies based in Germany is 3.8 billion Euros. Employees include active game developers, employees of publishers and local subsidiaries, but not retail game distributors or retailers, and service providers that are not also a game development studio or publisher. Employees working remotely in third countries are also included, but employees and subcontractors of subsidiaries in third countries are excluded.

Unsurprisingly, the local games industry varies greatly from country to country in Europe, from large countries such as Germany, France, Finland, Sweden, Spain and Poland to comparatively distant Norway and Italy. However, while there are a large number of game studios in Europe (over 5,300), especially independent studios active in development, there are very, very few global publishers, at most Ubisoft and Embracer. The same goes for distribution platform operators, with the exception of CD Projekt's GOG.com. Access to data is also limited, as the platform operators are usually based outside Europe. As a result, Europe is currently more of a development powerhouse that lacks publishing and distribution capabilities.

"If the EU wants to maintain its share of the global markets, the European game industry turnover should be well over EUR 40 billion by 2030, more than twice its current size. Without well-targeted public support, reaching this goal will be extremely difficult for the European game industry, leading to an even stronger American and Chinese game market dominance." EIT Culture & Creativity - 2022 State of the European Game Industry Report

The European markets, especially of course those in the EU, are not independant from European politics. In an additional article, we shone a light on the policy making of the EU when it comes to games, the available European funding as well as the two European associations EGDF and VGE.

Disclaimer: All parts of the "European Games Market" focus were first published in the print edition of GamesMarkt No. 464 on 21 August 2024.