Evaluation of German games funding suggests Changes and Tax Credits

The official evaluation of the German games funding system done by PwC makes clear: without the funding, the industry would be poorer off. However, the auditors also give recommendations for action: Simpler application processes and more knowledge transfer for small and medium-sized companies, tax credits for large companies are needed, so that a real "level playing field" comes into view.

The 150 page report on the evaluation of federal games funding by auditors PricewaterhouseCoopers (PwC) was published on December 6. At a press conference, the Federal Ministry for Economic Affairs and Climate Protection (BMWK) as the client and PwC presented the most important points of the report. The report serves as a prelude to discussions with the industry, the first stakeholder talks of which are to take place December 7 at and around the German Developer Award.

The report consists of an evaluation of past funding methods both in the de minimis funding from 2019 to 2021 and in games funding since 2021, an international comparison of the funding model and recommendations for action for the BMWK when revising the funding.

The evaluation by PwC is based on data from the German industry association game, a study conducted by the Hamburg Media School in 2020, workshops at gamescom 2023, interviews with the BMWK, the funding managing organ DLR-PT, the game association's members and a selection of funded and non-funded companies. This was supplemented by a representative online survey of the industry, to which, according to PwC, a surprisingly high number of industry representatives responded.

According to PwC, games funding should achieve four objectives for the German games industry: it should contribute to increasing the number of employees in the industry, to increasing the number of game releases, to strengthening the positioning of the German industry on the international market and to increasing the number of companies in Germany.

In retrospect, games funding generally performs well. 70 per cent of de minimis funding recipients were able to create new jobs and 75 per cent published the funded project.

The federal government's computer games funding has also had a fundamentally positive impact. Funded companies have created an average of 6 full-time jobs per funded project in Germany since 2021, with the distribution varying massively depending on the size of the company: for micro-enterprises, the average is two jobs, for small companies five, for medium-sized companies eight and for large companies a full 137 jobs. The average is therefore not very representative. Nevertheless, non-subsidised companies only created four jobs each in the same period, which indicates a positive effect of the subsidy. A total of 1,458 full-time jobs are said to have been created since 2021 as a result of computer games funding. 67 per cent of the funded games have also been published to date, according to the report, which has a cut-off date of the end of June 2023. 80 per cent of the companies surveyed rate the contribution of the funding as positive, while 35 per cent say that the funding has opened up a new target group for their project.

In addition, PwC recorded the spillover effects from games funding, which are not a prerequisite for previous funding from the BMWK, but could be considered for possible revisions to the guidelines. According to the survey, 84 per cent of companies have cooperated with other companies, of which 20 per cent are other developers, 26 per cent are publishers and 40 per cent are various service providers. 70 per cent of companies state that they have developed innovations, such as new tools or engine extensions, but only nine per cent of these have been taken up by other companies or even other sectors. PwC therefore considers the spillover effects to be mostly non-existent.

The study also makes a qualitative comparison of the German support system with six countries: Finland, France, Canada, Poland, Sweden and the UK are analysed based on data from the respective associations and interviews with market experts.

In doing so, PwC identified four possible systems: tax incentives or tax credits, non-monetary incentives, subsidised loans and project-related non-repayable grants, of which federal funding currently only covers the latter - unlike all other countries examined, which combine at least two forms in each case.

PwC presentation focussed on the two systems of tax incentives and non-monetary incentives. Tax credits exist in Canada, France and the UK, with France showing the greatest growth in the number of companies of all the countries analysed, Canada having the largest proportion of workers in the games industry in relation to the total population and the UK having the most games companies per million inhabitants.In all three countries, tax incentives are the most sought-after form of support for the industry.

Non-monetary support, for example in the form of training, knowledge transfer and hubs, can be found in Sweden, Poland and Finland. Here, pwc emphasises Sweden, which has no specific games funding, but whose industry-independent technology funding is of particular benefit to games companies:The country has the highest games funding per capita, despite the lack of a specific games funding programme.

In addition to the data, PwC bases its recommendations for action on the wishes of the industry. These are expressed as predictability, transparency, less bureaucracy through simpler application procedures and modern, simple online portals as well as different funding pots for different project sizes.

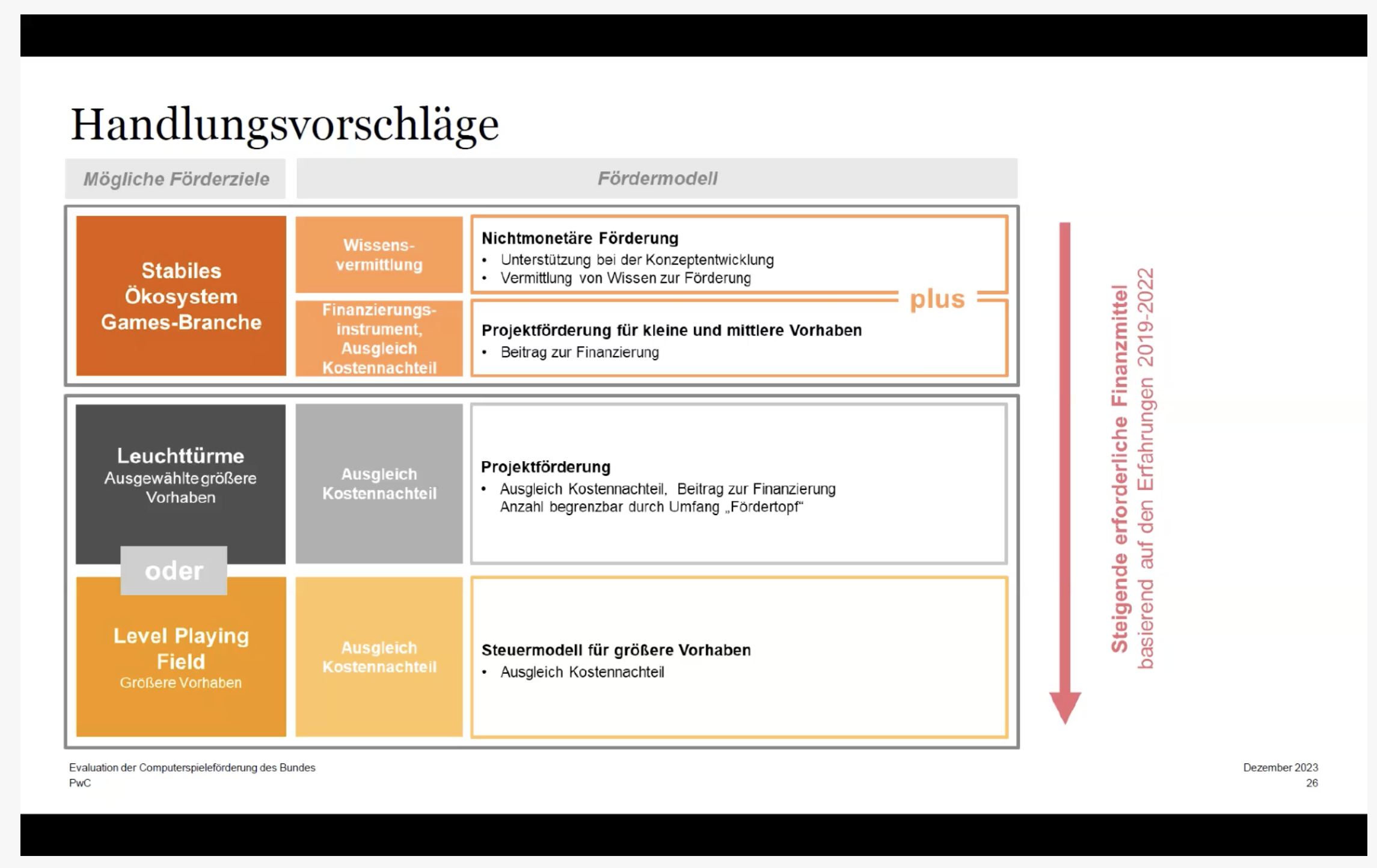

PwC's recommendation is based on a staggered model, which also becomes more expensive depending on the ambitions of the federal funding programme. For a stable games industry made up of small and medium-sized companies, the current level of project funding must at least be supplemented with a non-monetary transfer of knowledge, which on the one hand provides knowledge on how to apply for funding and on the other hand enables spillover effects.

PwC proposes two options for funding large companies. If large companies continue to receive project-related, non-repayable grants, this will keep the costs for the federal government lower, but will probably only lead to a few lighthouse projects in Germany, as large companies need financial compensation in order to produce in the expensive location of Germany, but the pot does not provide an unlimited amount of money.

If a level playing field is to be created, i.e. if Germany is to become just as attractive as other international games production countries, PwC believes that a tax credit model must be introduced for larger companies in order to compensate for the location disadvantage. PwC proposes a model similar to the science funding that already exists.

The game association has already commented favourably on the results of the evaluation, but is also pushing for the recommended introduction of additional funding models. "The evaluation by the Ministry of Economic Affairs shows Games funding at federal level has triggered a strong dynamic in Germany - more games developments, more employees and additional sales.This means that almost all expectations of the funding have been met and in some cases even exceeded.This is impressive proof of the potential Germany has on the international games market if it offers competitive production conditions," says Felix Falk, Managing Director of game - Association of the German Games Industry."This successful path must now be consistently pursued. This requires sufficient funding, the amount of which is based on actual demand, as well as the introduction of tax incentives as recommended in the evaluation. If the recommendations from the evaluation are followed consistently, the result will be the urgently needed consistent games policy with reliable and internationally comparable funding conditions."

The BMWK has announced that it sees the evaluation as the impetus for a dialogue. The first talks with stakeholders from the games industry are set to begin on the occasion of the German Developer Award. According to the BMWK, the revision of the funding guidelines will focus on two points: Where can the current model be improved and what additional models are needed in the future. Tax credits are also to be considered, assured Federal Minister of Economics Robert Habeck.