Square Enix to Focus on Quality, Multi-platform and a new Organisation Structure

Square Enix is reorganising its business in the medium term. The Japanese publisher plans to focus on quality rather than quantity and to release its games on multiple platforms in the coming years. The company's organisational structure will also change.

Square Enix has announced a new medium-term strategy for its Digital Entertainment (DE) division, which includes the company's digital games for PC, console and mobile. The new direction will be based on four pillars. The first pillar is a shift from quantity to quality. They aim to create a portfolio that "a balance between a "product-out" approach that gives creators' imaginations free rein as they develop content, and a "market-in" approach that references customers' voices and data to inform our development efforts. Engage honestly with our customers and strive for a regular launch cadence, focusing our development efforts and investment on titles with strong potential to be loved for years", the company wrotes.

In addition, they intend to maintain and expand the fan base for their major franchises by releasing AAA titles on a regular basis, and to release mid-range titles based on strategies for individual line-ups, but prioritising profit. Square Enix will also move away from its business unit-based organisational structure and revamp its internal title development. They "strive to establish an operationally integrated organization with the goal of revamping its internal title development footprint and bringing more capabilities in-houses." There are also plans to move to a project management structure that strikes a balance between individual creativity and organisational management.

The Japanese publisher will be aggressively pursuing a multiplatform strategy that includes Nintendo platforms, PlayStation, Xbox and PC. They want to "create an environment where more customers can enjoy our titles in terms of major franchises and AAA titles, including catalogue titles". Although Square Enix releases many "HD Games" on PC and consoles, the two AAA RPGs Final Fantasy XVI and Final Fantasy VII Rebirth have only been released on PlayStation 5 so far, with PC adaptations to follow but no date set. As for "SD games", not only are releases on iOS and Android planned, but also games for PC. Square Enix explains on the slides: "Maximize the acquisition of new users when launching a title and that of recurring users after starting management of game operation." The company is also looking to maximise digital sales of new titles. It is also pursuing initiatives to attract PC users. The PC market is specifically identified as a growth area.

The company plans to rebuild overseas business divisions in Europe and North America, "introducing policies on organization and human resource allocation in Japan Enhance business infrastructure by implementing PDCA cycle in a timely and appropriate manner." The aim is to strengthen cooperation within the Group in Japan and abroad - as well as the functions of the London development centre. Finally, in allocating capital, they aim to strike a balance between shareholder returns and growth investments. This includes a maximum allocation of 100 billion yen, nearly 593 million Euros, for strategic investments over a three-year period (20 billion yen, roughly 119 million Euros, for share buybacks next year).

In the last fiscal year (FY2024), the company sold 26.32 million games (+3.88 million compared to the previous year), 20.19 million digitally and 6.13 million physically. The percentage of boxed games also continues to decline for the Japanese publisher (2024: 23.3%, 2023: 29.4%).

Square Enix has released its results for fiscal 2024, from the beginning of April 2023 to the end of March 2024. Revenue increased by 3.8 per cent to 356.3 billion Yen, nearly 2.1 billion Euros. Operating income fell by 26.6 per cent to 32.5 billion yen, nearly 193 billion Euros. "Profits are down, partly on content production account valuation/abandonment losses," says Square Enix. However, this decline is also partly attributable to the write-down of approximately 130 million Dollars in the course of cancelled projects, aka "content abandonment losses".

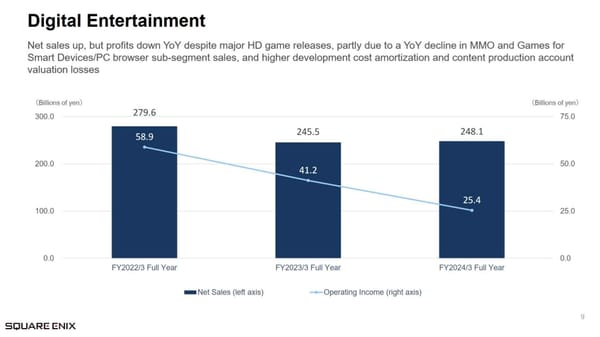

The company writes about the Digital Entertainment division, which is the main contributor to the company's sales: "Net sales up, but profits down YoY despite major HD game releases, partly due to a YoY decline in MMO and Games for Smart Devices/PC browser sub-segment sales, and higher development cost amortization and content production account valuation losses". The HD Games segment reported net sales of 99.2 billion yen (+26.4%; 589 million Euros). However, operating loss almost doubled to 8.1 billion yen (48.1 million Euros). Releases included Final Fantasy Pixel Remaster, Final Fantasy XVI, Star Ocean The Second Story R, Dragon Quest Monsters 3, Foamstars and Final Fantasy 7 Rebirth. The MMO segment, led by Final Fantasy XIV Online, contributed 47.3 billion yen in sales (281 million Euros), while games for smart devices/PC browsers contributed 101.5 billion yen (603 million Euros).

Never miss anything from the German, Swiss and Austrian games industry again: subscribe for free to our Daily newsletter and get all news straight to your inbox.